Advertisements

It's time to find out how to apply for your loan of up to R$2,500. Check it out!

If you are on this page, you have probably already decided to do the SuperSim online loan. Just start your request, run the simulation and complete!

With SuperSim, everything becomes simpler. It is a completely online platform that provides super practical and safe loans to make receiving loans easier. After your loan is released, in about 30 minutes the money can be in your account via Pix.

Advertisements

With rates starting at 14.9% am., you may have the chance to start solving some more urgent problem you face, but remember, interest rates vary depending on the customer profile and chosen loan method.

Who can apply for the SuperSim loan

This is undoubtedly one of the biggest questions when thinking about taking out a loan. Can you afford it, regardless of your current financial situation?

Advertisements

The platform is known for reaching an incredible portion of the public, being able to release loans even for people with negative credit ratings or restrictions on SPC and Serasa.

Even for those who are not in debt but have a low score, the SuperSim online loan It is a way to solve a more urgent financial problem or take a step towards fulfilling a personal desire.

It is worth remembering that personal loans in SuperSim are only intended for people over 18 years old and who can prove their income.

Step by step guide to applying for a SuperSim loan

With the process done entirely online, there is no big mystery to requesting your SuperSim online loan and what's more, you won't even have to face long lines.

After filling in your details, the platform will quickly provide a response on whether or not your loan will be approved using artificial intelligence.

To avoid any doubts, we have prepared a step-by-step guide to help you feel more at ease when requesting your loan from SuperSim.

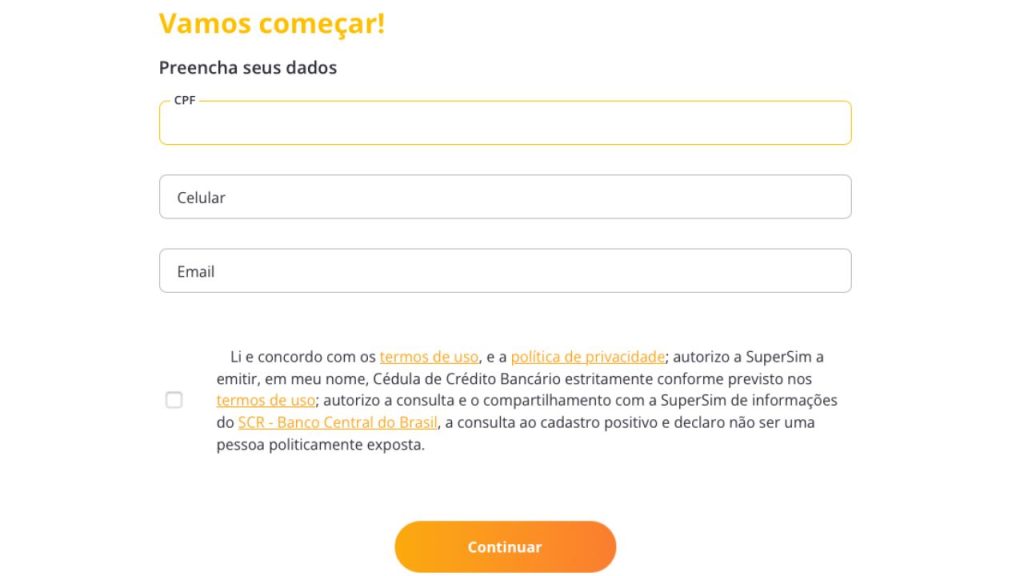

Step 1

When you enter the SuperSim website after clicking on a button during the article, you must fill in all your requested data (CPF, cell phone and email). Once this is done, check the box to accept the terms and press the continue button. Remember that the allowed values are between R$ 250.00 and R$ 2,500.

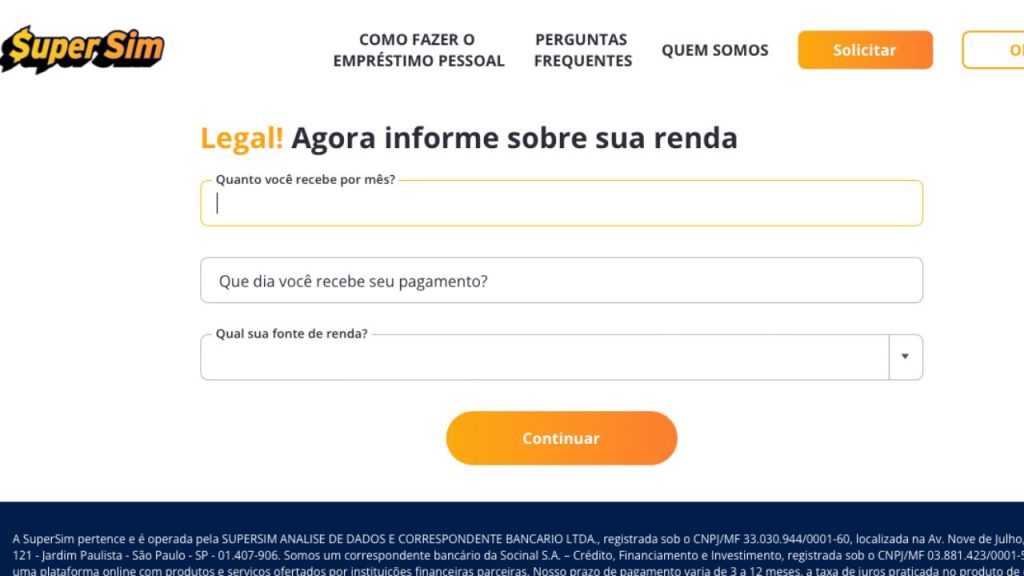

Step 2

On a new screen, it's time to talk about your income (remember that you need to prove it). Fill in the requested information, such as how much you earn per month, the payment date and your source of income.

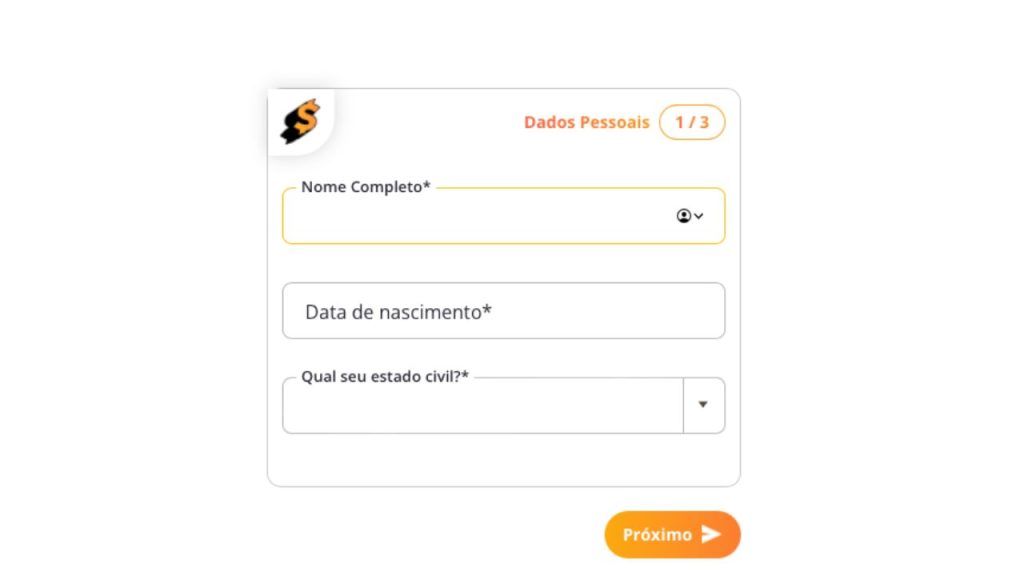

Step 3

Now you will have to provide your personal details to continue with the loan application. Name, date of birth and marital status. Next, you will be asked for your bank and residential details to complete the application.

Step 4

With everything already filled out, it is time for the SuperSim system to properly analyze your profile and thus determine whether or not to approve your loan application.

The process usually takes less than 10 minutes to complete the request. If everything is ok and SuperSim approves, in about 30 minutes the money will be in your bank account, which you provided at the time of registration.

APPLY NOW